June 27th, 2017

Four-Oh-Wonk. The Reboot.

April Edwards, MD

April Edwards, MD, is the 2016-17 Chief Resident for Internal Medicine/Pediatrics program at the University of North Carolina School of Medicine.

At the beginning of the year, I wrote about the rude awakening I was experiencing with regard to my own finances. I heard from more than a few other imminent or recent resident graduates who expressed some degree of similar feelings of being inadequately prepared in the financial realm.

At the risk of being incredibly rudimentary, I thought now was as good a time as any to try to share a few small lessons and gems of information I have been gleaning during the past year. I am finally trying to take an active role in my finances rather than continuing to bounce from paycheck to paycheck, still naively thinking that “Financial Literacy” was something I’d “get around to later.”

Disclaimers:

- I probably represent a rather extreme version of financial ignorance, and I suspect that most residents likely are a bit better versed in some or many of these basics. But this is targeted at others who might still be lacking financial savvy. In no way do I think this is the “right” way or only way to start trying to boost one’s financial IQ, but I wanted to offer it up as a way for people to at least get started.

- Almost all of what I am going to write comes from a book I happened upon that knocked the rose-colored glasses right off my face, “I Will Teach You to Be Rich,” by Rhamit Sethi. I have absolutely no ties to the author, and I will get exactly no props or cash money for talking about it, as he has no idea who I am or that I have read his book. But I did find the book (despite the title, which I initially found a bit off-putting) to be a FANTASTIC financial primer for typical resident aged/minded folks. (I may or may not have found it when Googling “finances for dummies”…)

So here are a few of my thoughts — if you find any of them useful, amazing! If not — totally fine, too. I just want to keep re-circulating this topic into the general conversation for residents. And, I’ll probably sit on my porch in a rocking chair looking at the shiny fresh new resident Whippersnappers who are about to start their career, wave my cane, and say “Don’t be like me! Learn from my mistakes!”

Ok. Here goes.

1. Download Mint (www.mint.com)

Or something like it. Mint is an app/website that will let you track every single (cash or non-cash) penny that you spend. You input your various bank/credit/debit card/savings accounts, and then it shows them to you ALL IN ONE PLACE. Which is amazing. Because this is probably a good place for financial novices to start — take inventory. How much money do you have? How much do you owe and to whom? I’m sure many Attendings used to do this sort of thing with an Excel chart or even by hand, which is also totally fine, if that is your style. The point is, take inventory. Do it now.

2. Look at where your money is going

Now that you have all of your financial info in one spot, look at what you are actually doing with that money. Mint (and Mint-like apps) makes it simple, because it automatically labels each of your transactions and keeps track of each category. Then, it provides nice visuals, like a pie chart that shows you what proportion of your money you are spending on, say, Travel versus Eating Out. It’s a nice way to catch things you probably don’t think about regularly — like the various monthly subscriptions you bought for Netflix/Hulu/Spotify, since those usually autodraft (and, out of sight, out of mind, right?) You can play with the categories as much as you want to make them make sense for you — for example, I have a category labeled “Colby” for pet-related expenses for the world’s greatest dog, Steven. T. Colbert Edwards. An expensive booger.

3. Determine fixed vs. flexible costs

From the inventory you made (of the things on which you are spending money), figure out which of those are true fixed costs — i.e., they are monthly or weekly “must pays.”  These generally consist of things like rent, utilities, cell phone, groceries, pharmacy, gas, car insurance, and debt/loan payments. Plus any of those recurring monthly subscriptions. Go back several months to look at the average cost for each of those, and write them down. Then look at “everything else,” which are your flexible expenses: Eating out. Trips. Gifts. And all your myriad one-time and unplanned expenses: License renewal fees, Board registrations, QBanks, interview hotels/rental cars, parking tickets. (FYI, I could write an entire other post on all of the hidden costs of finishing residency — Turns out that it costs a lot to graduate into being a real doctor.) Anyway, now zoom out. Is that what you thought you were spending on that stuff? In my case, I was spending way more than I realized, just not by really paying attention to where my money was going each month.

These generally consist of things like rent, utilities, cell phone, groceries, pharmacy, gas, car insurance, and debt/loan payments. Plus any of those recurring monthly subscriptions. Go back several months to look at the average cost for each of those, and write them down. Then look at “everything else,” which are your flexible expenses: Eating out. Trips. Gifts. And all your myriad one-time and unplanned expenses: License renewal fees, Board registrations, QBanks, interview hotels/rental cars, parking tickets. (FYI, I could write an entire other post on all of the hidden costs of finishing residency — Turns out that it costs a lot to graduate into being a real doctor.) Anyway, now zoom out. Is that what you thought you were spending on that stuff? In my case, I was spending way more than I realized, just not by really paying attention to where my money was going each month.

4. Make a conscious spending plan

Now that you know where your money went when you weren’t watching it particularly closely, you can turn the tables (on yourself), take the Code Team Leader lanyard, and start being the one calling the shots. Use the data you collected to actually plan how you want to spend your money. You already know the monthly amount of your incredibly exorbitant resident salary, and you know the unavoidable/fixed costs you have each month. Some general thoughts about how you should divvy up your money. Some “experts” suggest that, generalishly, your categories should look like this: All of your fixed costs together, ≈60%; savings, ≈10%; retirement and other investments, ≈10%; guilt-free spending, ≈20%. Again, this is a rule of thumb and, in this particular case, my thumb ala Ramit Sethi. But you get the general idea. Also, quick word(s) about those groups:

- Fixed Costs (60%): Get rid of the stuff you don’t actually need to be eating into your money. Never watch Hulu? Cancel it. Have a subscription to a medical journal you always pretend you are going to read, and never do? Cancel it. (Plus, your university/hospital probably allows you to access most of the big name medical journals, so you can still read them if you want.) Make sure you’re only paying as much as you need to for stuff like your cell phone bill (downgrade to a lower-cost plan if you don’t need “unlimited minutes and messages”) or your cable bill. Seriously, call up the companies and ask them to slim you down to a plan/package that “fits” your usage.

- Savings (10%): This one is hard, but try to have some. Some big-ticket items will require residents to have extra money around at some point — a wedding, a car, a baby or three, a down payment on a house. We probably all envision ourselves spending a good chunk of money on one or more of those things “later,” but it makes a lot of sense to put some money in those pots, so there is something from which to actually draw on when it gets to be “later.” Also, another less sexy category that you need to fund is “emergency/rainy day account”. (Or, more likely, lost job+got injured+unforseen repairs needed+rain). The rain alone you could probably deal with. You know, because, umbrellas.

- Retirement/Investment (10%): Your hospital has some sort of retirement account that you should ask the GME about, so you can fill out the (generally single-page) form to get started. This is the 401k, 403b, 457b stuff. It’s alphabet soup — but it’s worth Googling to understand. Basically, start saving for retirement now, if you haven’t already. Most hospitals will help you out by automatically funneling some of your salary (as long as it follows their guidelines/contribution rules) directly into a retirement account associated with the above alphabet soup. And this happens before you ever see that money. Which means it is a whole lot easier not to miss it — because it was never part of what you were taking home in the first place. Huge psychological win. And if you want to be super fancy, you can also have your own (not necessarily work-affiliated) investment/retirement accounts. Like an IRA or Roth IRA. Turns out that if you put money in investment accounts, instead of under your bed (or even in one of the super low-yield savings accounts that most of us have), it will probably grow over time. Which is why people recommend investing. Giving investment advice is way beyond my pay grade, but learning at least a little about it is worthwhile. Investment managers make essentially the equivalent of a nicely arranged manila folder with the right balance of individual investment-colored papers in it — called index funds. They are pre-mixed investment portfolios for people like me who do not know how to build a “well diversified portfolio.”

- Guilt Free Spending (20%): The point of this category is that, if you have done a good job at knowing how much you are going to be spending on fixed costs, then whatever money you have left over each month you can spend with a relatively clear conscience. You don’t have to worry that you’ll default on your credit card payment or won’t be able to make rent, because you already set aside that money. This is where eating out, travel, gifts, and concerts come in. No one wants residents to be any more burned out that they already are. So, with a little work on the front end, you can feel relatively assured that you can truly use the left-over bit for things/hobbies/extras that are important to you.

5. Make your credit score sexier

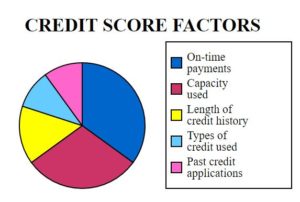

Credit scores matter a whole lot going forward. They are basically the financial health equivalent of a Medical Record FaceSheet. It’s a snapshot look at your financial “health.” How good are you with money? People who you will need to lend you money (banks, credit cards issuers, car salesmen, mortgage brokers) want to know how risky of a move it is to trust you. In this realm, instead of looking at medication adherence, health maintenance screening, and number of chronic medical conditions, lenders look at several dimensions of your financial health. The basic components are:

- What is the balance of credit/other people’s money that you owe vs. how much you have available to you/been approved for (credit utilization rate)?

- For the money you already owe, how good are you at paying on time?

- How long have you been at this whole borrowing money business (i.e., length of credit accounts, old vs. new credit)?

- How varied are your credit types? (Better to have your risk spread around in different types of credit — credit cards, student or car loans, mortgages — than all in one type.)

You want your score to be basically as high as you can get it, because this means you look “healthier” to potential lenders, and they are more willing to offer you credit, without making you pay through the nose. Many banks and credit cards have programs that will keep tabs on your credit score month to month (so does Mint), which can be useful. Scores range from 300 – 850. Above 700 would be a good goal. But how?

- The non-sexy answers are: Be a good steward of your credit. Pay your bills on time. Don’t willy-nilly accept credit card offers for which you’re “pre-approved,” just because you got them in the mail, or because you saw a funny commercial with Alec Baldwin. Don’t borrow more than you need (and, hopefully, you have a good idea of what you actually need, based on the steps above).

- One quick move you can try that actually helps is to ask for an increase in your credit limit on your current credit cards. As mentioned above, part of calculating your credit score is your credit utilization percentage (amount used/total available or offered). So, harkening back to the days when we did actual math — increasing the denominator will make the overall percentage amount lower. You can literally call up your credit card company and say something to the effect of “Hi there, I’ve been a loyal customer for X years, I pay my bills on time, and I would like to request a credit line increase.” As long as you have been pretty reasonable with your accounts, they will often just do this for you on the spot! One of my cards tripled my limit during a 5-minute phone call. **Important: The point of doing this is to make you owe a lower percentage. It is NOT for you to spend more! That will literally defeat the purpose and shoot you in the foot.

6. Automate good decisions

Now that you have a basic background on how you have been spending your money and how you want to be spending your money, set it up so it happens automatically each month without you having to think about it! Get direct deposit for your paycheck. Then, link your checking, savings, and retirement accounts so that money is taken from your now replete checking account and neatly and automatically distributed into the other “pots,” loosely based on the allocation suggested above. This way, it happens without you having to remember or choose to do it each month. It will help you be fiscally responsible while you sleep (or more realistically, while you are on call)!

Phew. That was a lot. Bottom line, take a look at what your current spending is like on a granular level. Then decide what is important and what you need to be spending and saving. Set up your system to make that happen automatically so it doesn’t have to be another check-box at the end of each month. Be smart about credit, pay your bills on time, and push your credit score as high as you can get it.

I hope this was helpful to at least a few residents. Perhaps, like me, you didn’t get a solid background in this stuff earlier on, for whatever reason. It’s not the only way to think about finances, but it helped me, and I want to pay it forward. I know you guys are busy. Pouring your hearts and minds into doing good work. Keep it up. If no one has told you already this week, Thank You for what you do. Hopefully this can fall into the realm of “self care” and will help you build a solid foundation going forward.

Be well.

Basic life skill many missed out on – but like you, many DIY – and found a BETTER result than other family members usually!!!

Good reading..

Have you checked out The White Coat Investor? He’s an ER doc that has an interest in finances. He has a website but he has also written a stellar book about physician financial issues and how to navigate them. Worth a read.

Great article and great thoughts.